According to the best geographical location, Dubai is considered as one of the rapid-growing capitals in the world. As the most important business and economic hub of UAE’s, it is a best-suited place for various company startups. Among other unique facilities of Dubai, rapid expansion, steady economic condition, promising tax choices are the main attractive features.

The Dubai government offers a great business environment for entrepreneurs from all around the world. Being the world's best corporate center Dubai attracts more investors and businessmen than others. It is also a city known for providing the best opportunities for new company setups across different sectors. Hence for investors and foreigners opening a company in Dubai will not only be profitable but also be prestigious.

Though the company setup procedure in Dubai is a bit lengthy yet relatively hassle-free. Before beginning to set up any company in Dubai one must have a clear vision of the type of company they want to start. There are various company options are available for the businessman and foreigners in Dubai.

- Limited Liability Company (LLC)

- Free Zone Company

- Offshore Company

- Joint Partnership

- Branches

- Representative Offices

Common types of company in Dubai

Limited Liability Company (LLC):

- Most common type of company in Dubai.

- Allow a foreign company to become a shareholder.

- Legal liability is limited.

- Need highest of 50 partners to register company.

- A client doesn't need to travel.

- Local and global trade and services are permitted.

- Need to elect a least of one manager and the highest of five managers for the company.

- Approximately 2 months needed to set the company.

- Must need to collect Trade License and Commercial Registration Certificate.

- Allowed to rent an office in Dubai.

- 5 weeks require to open a bank account for the company.

Free Zone Company:

- Can have full foreign ownership.

- Can enjoy 100% cent import and export tax privileges.

- Doesn't have any currency restrictions.

- Limited legal liability.

- Can get UAE residence visas.

- Can conduct all kinds of businesses including trading, service and industrial enterprises.

- Cost Effective and affordable company type.

- Can lease an office in Dubai.

- Need to file the yearly tax return.

- The time needed to set up the company is Approximately 2 months.

- Can issue sales invoices in Dubai.

- To open a bank account, need 5 weeks.

Offshore Company:

- Also recognized as a non-resident company.

- A perfect tax and cost-effective corporate structure.

- Can have 100% foreign ownership.

- Limited Legal Liability Company.

- Can easily control multi-currency Bank accounts in the UAE.

- Can own UAE property.

- Don't need to file an annual tax return.

- Can't lease an office in Dubai.

- Can do trade internationally.

- Isn't allowed to import or export assets.

- Residence visa aren’t allowed.

- Needed 2 weeks to complete the setup.

- Not permitted to issue sale invoices in Dubai.

- Can open a corporate bank account in 6 weeks.

Read: How to register a company in Dubai as foreigner

Short briefing on the requirements of Common company types to setup in Dubai

| Requirements |

LLC |

Free Zone Company |

Offshore Company |

| Required least shareholders |

1 |

1 |

1 |

| Need local shareholder? |

YES |

NO |

NO |

| Needed least share capital |

US$1 |

varies |

US$1 |

| Least allowed directors |

1 |

1 |

2 |

| Need annual financial statements? |

YES |

YES |

NO |

| Need any resident director? |

NO |

NO |

YES |

| Corporate shareholders acceptable? |

YES |

YES |

YES |

| Need any local sponsor? |

YES |

NO |

NO |

| Individual shareholders acceptable? |

YES |

YES |

YES |

| Require statutory audit? |

YES |

YES |

NO |

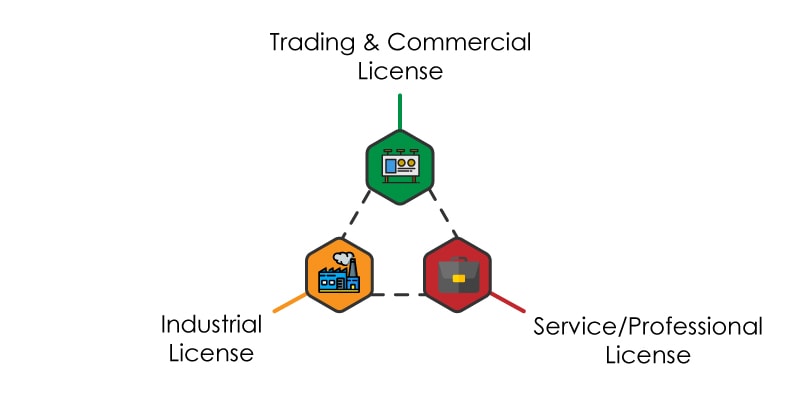

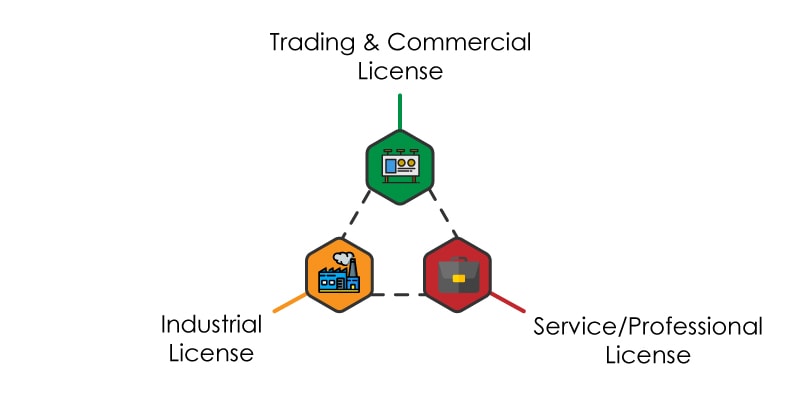

Types of Licenses available for the company in Dubai

According to the chosen company type investors need to select a suitable license for the company. Dubai Chamber of Commerce and Industry (DCCI) offers the following types of licenses for a company:

Trading & Commercial License:

- Can be a common or particular trading.

- Includes import, export, re-export, and distribution etc. of particular products.

Service/Professional License:

- Can do particularized professional services.

- Can also do activities like promotion, event or display organization, washing services, etc.

- Needs a consultation with the sales administrators.

Industrial License:

- Issued to function any investment activity.

- Provide permission to import raw materials, production of specified products and trading the complete goods.

- Permits the owner the equal status as a local inside the UAE.

Basic requirements to setup a company in Dubai

- Among various available legal company type, choosing one type is the 1st task for company setup.

- According to the chosen company type businessman need to determine which company activity will be suitable to obtain. Multiple business activities are permissible for one trade license Holder Company.

- An investor can choose their company activity according to the list from the Department of Economic Development (DED).

- In accordance with the activities, one needs to select a legal form.

- Next, a suitable and non-offensive company name or trade name needs to be selected. The chosen name should be unique means not used by other company.

- Investor will need to collect a Primary Approval Certificate allotted by the Government of Dubai.

- A Memorandum of Association (MoA) needs to be prepared based on the company type.

- It's a must to select a physical location in Dubai.

- One must acquire and approve a suitable company license depending on the company type.

- Finalizing other necessary documents. Such as, non-Objection Certificate (NOC), copies of passport (shareholders and directors), business plan summary etc.

- Must open a corporate bank account for the company setup process.

- Lastly, need to obtain visas for completing the company setup process in Dubai.

Estimated short costs chart to set up a company in Dubai

| Service |

Costs |

| Registration and License |

2,000 AED |

| Trade name approval |

720 AED |

| Address Services |

9,500 AED |

| Flexi Desk |

16,000 AED |

| E-Channel Registration Deposit |

7,150 AED |

| Residence Visa for one person |

4,000 AED (approx.) |

| Global Resources Professional Fees |

6,000 AED |

| Initial approval from economic department |

220 AED |

Dubai is one of a well-recognized country with a business-friendly environment to do business easily. It provides a state-of-art infrastructure and a very simple company setup process for both local and foreign investors. Setting up a company in Dubai will surely bring numerous business opportunities in Dubai for the businessman to flourish.

FAQ

How much does it cost to set up a company in Dubai free zone?

The cost depends upon the free zone that you choose for your business. Usually, the licensing of a company in a free zone starts from 10000 AED.

How much does it cost to register a trade license in Dubai?

It will cost around 15000 AED to obtain a trade license in Dubai.

Can a foreigner open a bank account in Dubai?

Foreigners are only allowed to open a savings account in Dubai. However, if a foreigner has a registered company in Dubai, he/she is permitted to open a corporate bank account. To open a current account, a foreigner must have a permanent resident in Dubai.