Income tax Bangladesh is maintained under income tax ordinance 1984 and the definition of tax is to charge. Tax is a financial contribution exacted by the country. According to Article 152 (1) of the constitution of Bangladesh, tax includes the imposition of any tax, duty, rate whether general or local. It is the source of revenue of Bangladesh government. As economist, Adam Smith tax is compulsory payment to government by the tax payer.

Character of tax: Tax is payment to government of Bangladesh by tax payer as Section 83 of Bangladesh Constitution. Tax is not the cost of the benefit conferred by government on the public. Tax is not any fine or penalty.

Revenue collection: Income tax Bangladesh government is the main source of revenue collection that is almost 75 percent of total government revenue. Personal tax rate and corporate tax information.

Classification of tax: a) single tax b) multiple tax c) direct tax d) indirect tax that is comes from sales or purchase of goods or services like VAT and custom duty.

Basic structure of income tax Bangladesh

General tax structure of Bangladesh consists of both direct and indirect tax and as so, direct taxes are income tax, registration, gift, stump, immovable property and so on whereas indirect taxes are VAT, TT, foreign travel, excise duty, vehicle tax, electricity duty and so on.

Income tax holiday scheme: According to section 45, 46, 46A, 46B and 47 of income tax Ordinance 1984 any company is registered within specific area is exempted tax for certain period,

Investment allowance: investment allowance is given to purchase new machines to attract the investors.

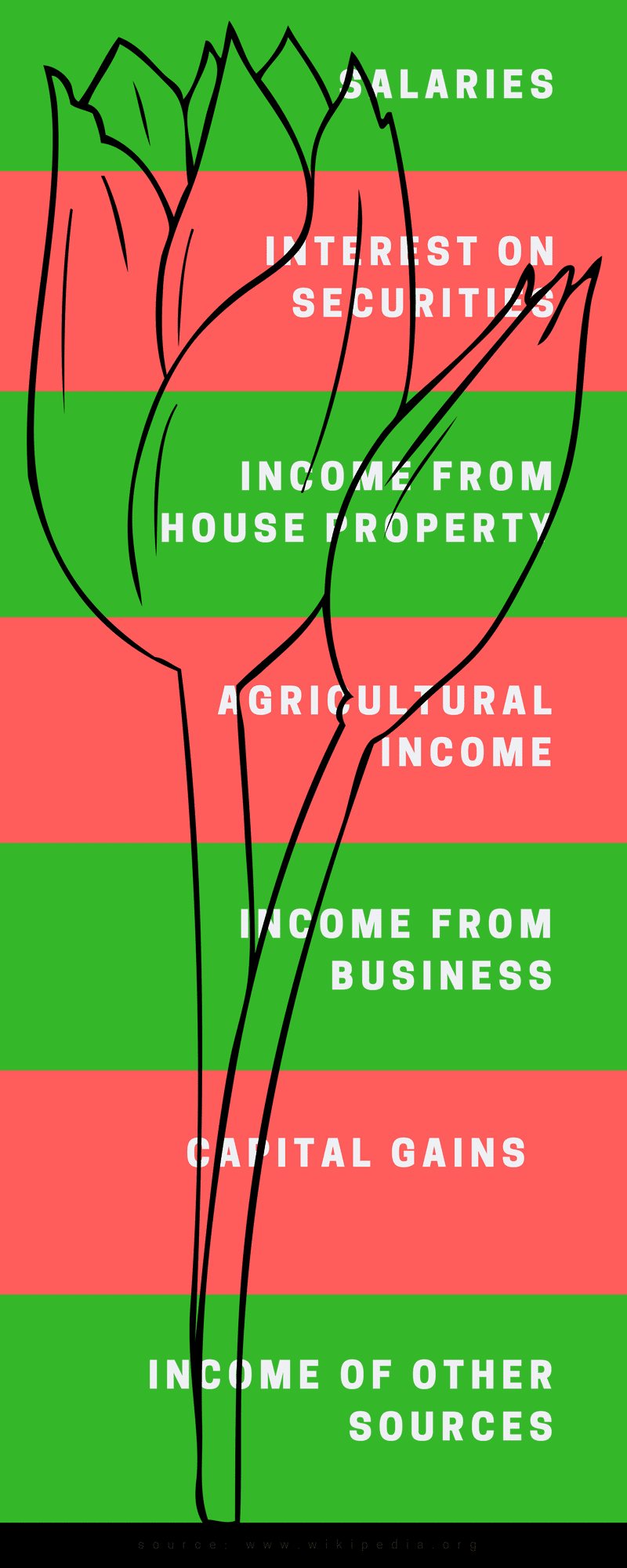

Head of income of Bangladesh government as 7 (seven) categories:

Female tax payer if age is equal or above 65 years

Tax rebate for business investment in Bangladesh

Tax rebate amount is 15 (percent) of allowance investment. Amount of actual investment is 30 (percent) of total income or Taka 1500000 which is less.

Tax rebate for following types of investment

Who will pay tax?

Income tax holiday Bangladesh is permitted for the industry and physical infrastructure if company is opened between 2011 to 2019 and maintain conditions.

As Section 46 B, the following industry is permitted for tax holiday by undertaking:

As Section 46 C, physical infrastructure allows of tax holiday:

Other exemption of income tax Bangladesh

-1st five years 100 percent tax free

-Next 3 years 50 percent tax free

-Next 2 years 25 percent tax free

Tax exemption for developers in EPZA as undertaking opening

-1st 10 years 100 percent

-11th years 70 percent

-12th years 30 percent

-1st 3 years 100 percent tax free;

-4th year 80 percent;

-5th year 70 percent;

-6th year 60 percent;

-7th year 50 percent;

-8th year 40 percent;

-9th year 30 percent;

-10th year 20 percent tax exemption facilities;

Double taxation avoidance

UK, Singapore, Sweden, South Korea, Canada, Pakistan, Romania, Sri Lanka, France, Malaysia, Japan, India, Germany, Netherlands, Italy, Denmark, China, Belgium, Thailand, Poland, Philippines, Vietnam, Norway, Turkey, USA, Switzerland, Indonesia, Norway, KSA, UAE, Myanmar, Belarus

Tax incentives Bangladesh

Fiscal tax incentives

| Tax exemption | Rate |

| 1st 3 years | 100 percent |

| Next 3 years | 50 percent |

| Next one year | 25 percent |

Tax exemption rate if the enterprises are located in the following areas Chittagong, Dhaka, Comilla, Adamjee and Karnafuli Export Processing Zone.

| Tax exemption | Rate |

| 1st 2 (two) years | 100 percent |

| Next 2 years | 50 percent |

| Next one year | 25 percent |

Income tax rate Bangladesh changes yearly basis and government publish gazette for changing part.

Non-fiscal incentives

Other facilities

Company tax rate for 2017-2018

Nonpublic trade company: 35%

Public trade company: 25%

Bank financial institute: 40% to 42%

Cigarette and similar goods: 45%

Mobile phone operators: 45% with other conditions

Director’s/ shareholders of the company tax rate: NIL (zero) if income is less than Taka 2.25 crore, 10% tax if income is more than 2.25 crore and less than 5 crores (1 crore=10,000,000), 15% tax if income is more than 5 crores and less than 10 crores, 20% tax imposed if income is more than 10 crores and less than 15 crores, 25% if income is more than 15 crores and less than 20 crores, 30% if income is more than 30 crores as fixed.

Tax day example of Bangladesh

Enterprises have to pay tax before 7 months of ending the tax day of that income tax return date as follows, specimen, Tax day example of Bangladesh

| End date of tax year | Tax year | Tax day |

| 30 November 2016 | 2017-2018 | 15 September 2017 |

| 31 December 2016 | 2017-2018 | 15 September 2017 |

| 31 March 2017 | 2017-2018 | 15 October 2017 |

| 30 April 2017 | 2017-2018 | 15 November 2017 |

| 30 June 2017 | 2017-2018 | 15 January 2018 |

Person tax rate for 2018

As income tax Ordinance 1994, Section 2 (46) individual tax rate Bangladesh is as follows:

NIL (zero) tax imposed is income of the year is less than Taka 25,000, 10% tax rate if income is more than Taka 250,000 to Taka 400,000, 15% tax rate if income is more than 400,000 and less than 500,000, 20% tax rate if income is more than 500, 000 to less than 600,000, 25% tax rate if income is above 600,000 to 3,000,000 and rest of income tax rate is 30 percent.

Project company tax free (NIL) for 10 years

SRO no. 208, income tax, 2017 as income tax Ordinance 1984, as Section 44 (4), clause (b), as power of Bangladesh government or non-government Act, 2015, and under Act 22 if any Project Company from starting day to next 10 years 100% (full percent) income tax Bangladesh is exempted as follows:

Foreign employees (technicians) 50% tax free for next 3 years from joining date of above project companies. Moreover, income tax free for next 10 years on above project company’s royalty, technical know-how and technical assistance. Provided that, above mentioning person and company shall submit income tax return with 12-digit income tax number as same Ordinance of Section 35 and 75. This law shall active from date of 1st July 2017.

Withholding tax rate

Applicable for Financial Year 2017-18

| Head | Withholding authority | Rate | |

| Interest or profit on securities | Person responsible for any security of government | 5% | |

| (1) Advisory or consultancy service (2) Professional service, Technical services fee, Technical assistance fee. (excluding professional services by doctors) (Section 52AA) | Specified person as mentioned in section 52 | 10% if amount does not exceed 25 lac (2500,000) and if amount exceed 25 lac is 12% tax applicable. | |

| Meeting fees, training fees or honorarium | 10% if amount does not exceed 25 lac (2500,000) and if amount exceed 25 lac is 12% tax applicable. | ||

| Mobile network operator, technical support service provider or service delivery agents engaged in mobile banking operations | 10% if amount does not exceed 25 lac (2500,000) and if amount exceed 25 lac is 12% tax applicable. | ||

| Shipping agency commission | 6% if amount does not exceed 25 lac (2500,000) and if amount exceed 25 lac is 8% tax applicable. | ||

| Transport service, carrying service, vehicle rental service | 3% if amount does not exceed 25 lac (2500,000) and if amount exceed 25 lac is 4% tax applicable. | ||

| Rental value of vacant land or machine | 5% of rent amount | ||

| Share transfer | 5% | ||

| Dividend | 20% for foreign or local company and foreign or local person 10% (if TIN holder) and 15% if not TIN. |

(2) Any company making a payment in relation to the promotion of the company or its goods to any person engaged in the distribution or marketing of the goods of the company shall, at the time of payment, deduct tax at the rate of one point five percent (1.5%) of the payment.

Tax deduction rate from income of non-residents (foreigners) under section 56

| Description | Rate of tax deduction (%) |

| Income Tax Bangladesh deduction from consultancy service | 20 |

| Pre-shipment inspection service | 20 |

| Professional service, technical services, technical know-how or technical assistance | 20 |

| Architecture, interior design or landscape design, fashion design or process design | 20 |

| Certification, rating etc. | 20 |

| Charge or rent for satellite, airtime or frequency, rent for channel broadcast | 20 |

| Legal service | 20 |

| Management service including event management | 20 |

| Commission | 20 |

| Royalty, license fee or payments related to intangibles | 20 |

| Interest | 20 |

| Advertisement broadcasting | 20 |

| Advertisement making or Digital marketing | 15 |

| Air transport or water transport | 7.5 |

| Contractor or sub-contractor of manufacturing, process or conversion, civil work, construction, engineering or works of similar nature | 7.5 |

| Supplier | 7.5 |

| Capital gain | 15 |

| Insurance premium | 10 |

| Rental of machinery, equipment etc. | 15 |

| Dividend(a) company-- (b) any other person, not being a company-- | 20-30 |

| Salary or remuneration | 30 |

| Exploration or drilling in petroleum operations | 5.25 |

| Survey for oil or gas exploration | 5.25 |

| Any service for making connectivity between oil or gas field and its export point | 5.25 |

| Any payments against any services not mentioned above | 20 |

| Any other payments | 30 |

Advanced tax rate under Section 68 B

As above section, if person own by any motor car (vehicle) tax shall be deducted in advance as follows rate:

| Motor car with engine capacity | Advance tax, figure Taka |

| Up to 1500 CC car | 15,000 |

| Up to 2000 CC car | 30,000 |

| Up to 2500 CC car | 50,000 |

| Up to 3000 CC car | 75,000 |

| Up to 3500 CC car | 100,000 |

| Up to 3500 CC car | 125,000 |

| For micro bus | 20,000 |