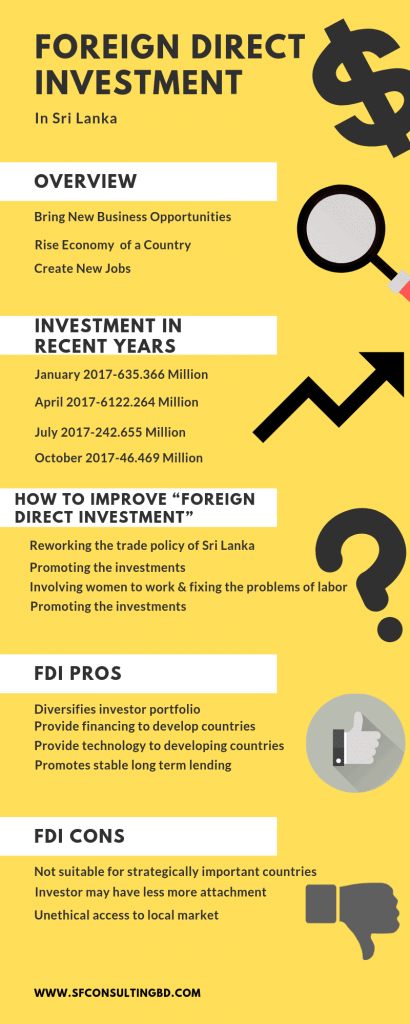

- Overview

- What is FDI and Why it is good for Sri Lanka?

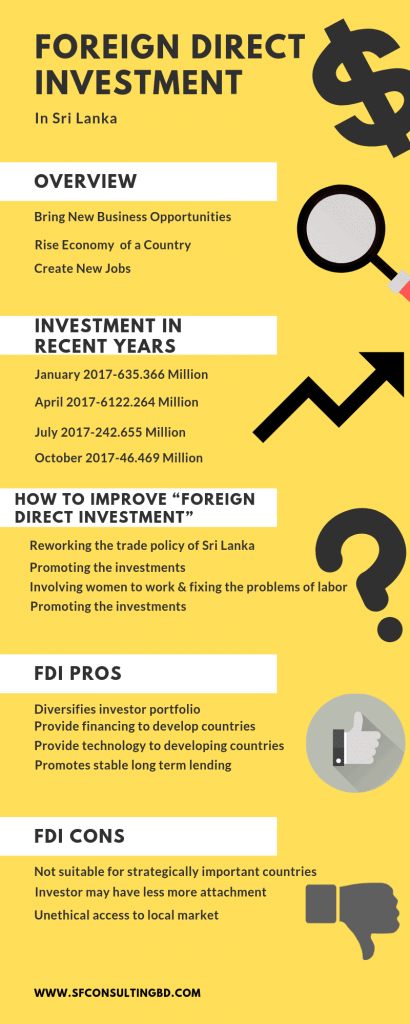

- Recent Overview of Sri Lanka FDI Investment

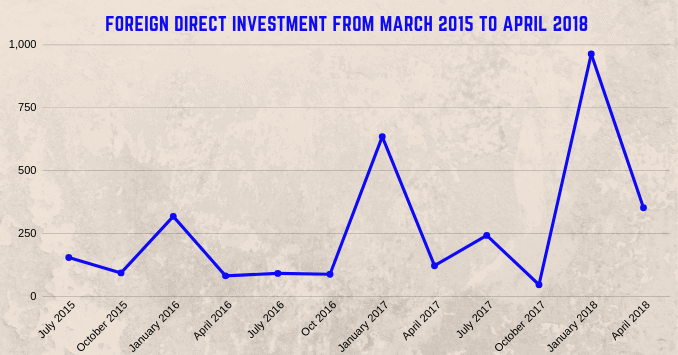

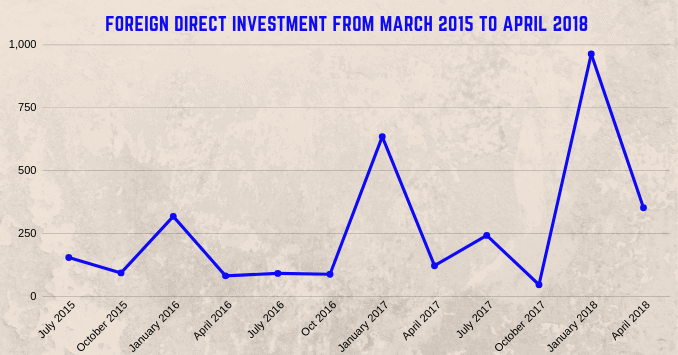

- Table of Foreign Direct Investment from March 2015 to April 2018

- How Sri Lanka can improve “Foreign Direct Investment”

- Importance of Foreign Direct Investments

- Foreign Direct Investment Pros and Cons

- Risks Associated with Foreign Investments

- Most attractive sector for FDI in Sri Lanka

- Advantage of Foreign Direct Investments for a country

- Disadvantage of Foreign Direct Investments for a country

- Conclusion

Foreign direct investment in sri Lanka step by step

Overview

To ease Foreign Direct Investment, recently Sri Lanka launched an innovative one-stop shop (Online). This one-stop online shop will help investors to achieve all types of official approvals. A recent report shows that “Foreign Direct Investment” in Sri Lanka is rising every year. Sri Lanka’s Foreign Direct Investment grew over $1710 billion in 2017, which also includes foreign loans received by the companies that are registered with the “Board of Investment”. According to a recent news Sri Lanka intends to boost more “Foreign Direct Investment”, which is up to $ 5 billion by 2020. The main motive of allowing more foreign direct investment is to improve the lives of Sri Lankan citizens by generating at least 1 million new jobs.

What is FDI and Why it is good for Sri Lanka?

What is FDI?

Foreign Direct Investment” (FDI) is a type of investment that is made by an individual or business in a foreign country. Sri Lanka government will use this investment money to bring good jobs and raise the salary of for Sri Lankan workers. Moreover, it also used for increasing productivity and to make the economy of Sri Lanka more competitive.

Recent Overview of Sri Lanka FDI

In 2018 the “Foreign Direct Invest” in the country increased by USD 719 million till June. It increases up to USD 352 million than the previous year. In June 2018 the current account of the country recorded a deficit of more than 1 billion dollars. Sri Lanka’s Foreign direct investment increased by $ 18.0 million in June 2018. Its foreign collection investment increased by $ 1.7 to 1.9 billion in June 2018. In June 2018 the country’s GDP was recorded about $ 21.4 billion.

Also Read - Sri Lanka Foreign Company Registration

Table of Foreign Direct Investment from March 2015 to April 2018

Sri Lanka fdi statistics

| July 2015 |

154.815 million |

| October 2015 |

93.573 million |

| January 2016 |

318.278 million |

| April 2016 |

81.855 million |

| July 2016 |

91.577 million |

| Oct 2016 |

88.251 million |

| January 2017 |

635.366 million |

| April 2017 |

122.264 million |

| July 2017 |

242.655 million |

| October 2017 |

46.469 million |

| January 2018 |

963.507 million |

| April 2018 |

352.291 million |

How Sri Lanka can improve “Foreign Direct Investment”

By creating a more flexible environment for investment Sri Lanka can improve Foreign Direct Investment (FDI). The flexible environment is also essential for domestic investors as well. Hare I am going to list six ways by which Sri Lanka can improve their Foreign Direct Investment (FDI). Improving logistics and trade expedition

- Reworking the trade policy of Sri Lanka

- Promoting the investments

- Enhancing innovation through competitive product and financial markets.

- Involving women to work & fixing the problems of labor.

- Provide and enable logistics and the proper infrastructural environment

Importance of Foreign Direct Investments

FDI Sri Lanka

Among many contributor’s “Foreign Direct Investment” is one of the most important contributors to the development of any country’s economy. The last quarter-century has witnessed remarkable growth in “Foreign Direct Investment” all over the world. FDI is one of the important factors for the development of the economy. Mainly “Foreign Direct Investments”, contribute economic development of the country in 2 ways: - These include increasing local capital and increasing efficiency through the transfer of new technologies, marketing strategy and management skills etc.

Secondly “Foreign Direct Investment” (FDI) has advantage and costs, and its impact is determined by the specific conditions of the country. Such as- the general policy of the country and political environment of the country.

Foreign Direct Investment Pros and Cons

| Pros |

Cons |

| Diversifies investor portfolio |

Not suitable for strategically important countries |

| Promotes stable long term lending |

Investor may have less more attachment |

| Provide financing to develop countries |

Unethical access to local market |

| Provide technology to developing countries |

|

Risks Associated with Foreign Investments

FDI risk

There are lots of risks associated with “Foreign Direct Investments”. As a foreign direct investor, you should always know the risks. There main 2 risks an international investor might face are highlighted below:

- Higher Transaction Costs: higher transaction cost is one of the biggest barriers to international investors. Though we live in an interconnected world the transaction costs may vary critically depending on the foreign market where you are investing. The fess and commission rate of brokerage is always higher in international markets than in local or domestic markets. Moreover, an international investor needs to pay additional fees to get their international business license and other related business papers.

- Currency Volatility: currency volatility is one of the biggest concern for international investors (mainly retailers). If you want to invest in the international marketplace you need to exchange your local currency to the currency of the country that you are investing in. The currency exchange rates up and downs frequently, which can affect foreign investors.

Also Read - Accounting & Audit Firms in Sri Lanka

Most attractive sector for FDI in Sri Lanka

There are various attractive sectors in Sri Lanka for foreign direct investment. Some of the attractive sectors for foreign investments in Sri Lanka are evaluated below: -

- Agriculture Industry: As a foreign investor, you can invest in the agriculture industry. The agriculture industry is one of the uprising industry in Sri Lanka. There are huge opportunities for foreign entrepreneurs in the area of supply and inputs. For example, exporting bio fertilizer, seeds, agricultural vehicle etc.

- Ceramic Industry: there are huge opportunities for foreign investors to invest in ceramic industry. Investment opportunities exist in the area of ceramic tableware, floor tiles, wall tiles, flooring blocks, building blocks, pipe fittings, ceramic pipes, sanitary ware, bricks etc. Compared to other Asian ceramic products Sri Lankan product is more unique and elegant because they illustrate ancient crafts. The availability of raw material (mud, calcium carbonate, kaolin) is the main advantage of Sri Lankan ceramic industry. Because of its availability, the raw materials are offered at a very reasonable price. However, the purity of these raw materials can contribute to the high standard of products. Some of the major business company in Sri Lanka ceramic industry are Noritake Lanka Porcelain (Pvt) Ltd (Japan), Samyang Lanka (Pvt) Ltd (Korea), Art Decoration Intl. (Pvt) Ltd (Germany) etc.

- Education and Skill Development: the education sector is another industry which can bring great opportunities for foreign investors. Now Sri Lankan governments want to improve their education system by introducing some major training for young entrepreneurs and professional. The designated area of training includes skills development, training in tertiary, vocational, technical etc. the other education program includes :

- Diploma courses for postgraduate, administration, business industry and services.

- For some approved courses now foreign industry can set international campus in Sri Lanka.

- International standard employment training.

- Training Institute for teachers

- Training on accounting and financial service.

- International BOP training institute etc.

However other investment in foreign institute includes textile industry, jewellery industry, Pharmaceutical Industry, Rubber Sector, Tourism & Leisure Sector, Machinery Industry etc.

Advantage of Foreign Direct Investments for a country

FDI advantages and disadvantages

FDI happens when an industry or business owns a minimum 10 per cent of capital in any foreign organization. Below I am going to highlight some advantage and disadvantage of FDI.

- International trade becomes easier: if any local companies want to import any product or goods from any foreign country they need to pay various kinds of taxes. Therefore, it becomes very difficult to keeps the price of the product affordable. However, compared to any local company a foreign company pay less amount of taxes to import any product. This is one of the ways- the price of the products can be kept affordable.

- Foreign income increases: there are lots of countries where employs make less than $4 for per hour of work. However, foreign direct investments can improve the rate of working. The most foreign direct company pays 15% more compared to local companies or business.

- Improves Human Resources: In underdeveloped countries, human skills are very limited. However foreign direct investments can improve human skills by offering educational opportunities, professional training for skill development etc.

- New Opportunities for Workers: people who are employed by an international company will have opportunities to travel and experience new cultures and concepts. Having experience of international standard will help them to make more productivity at home. Any foreign companies in the country create more work opportunism for the local citizen of the country.

Also Read - Small business ideas in Sri Lanka

Disadvantage of Foreign Direct Investments for a country

Disadvantages of FDI Sri Lanka

- Political Risks: political issues can change the international business environment at any moments. Political instability is very risky for foreign direct investments. There is always risks of the transaction and we cannot completely eliminate them. There are some countries where political risk is so high that FDI does not make any scenes.

- Affect currency exchange rates: In emerging countries where they are struggling against currency, the foreign direct investment may increase. People and companies regard investments as a sign of stability, which is of greater interest in the market. The higher interest rate can lead to a good value for a foreign state that can curb exchange rates.

- Domestic Investments Stops: minimum 10% investments in the country go to foreign companies. As a result, it becomes difficult for local companies to grow. Though the money comes back through FDI. However, domestic investment value is US dollar 1 for each dollar spent. Which means if you invest $5000 it could reach $10000 in the future.

Conclusion

In this article, I have discussed details about foreign direct investment in Sri Lanka. This article explains why Sri Lanka is suitable for “Foreign Direct Investments”. Starting a business in Sri Lanka will bring new opportunities for foreign entrepreneurs. Foreign direct investments bring twin benefits for both the investors and country.

Foreign Direct Investments plays a very important role in developing the economic growth of developing country like Sri Lanka. Sri Lanka is one of the emerging countries and has huge opportunities to attract “Foreign Direct Investment” (FDI) inflows. However, as a foreigner investing in Sri Lanka will be a wise idea. According to a recent report, the FDI in Sri Lanka increasing steadily every year. In 2017 the country reaches $1.38 billion which is more 53% in 2016. Well, now you need to check about Income tax rate in Sri Lanka for corporate and individuals.